KOGENERACJA S.A. is the main producer of heat in Wrocław and a producer of electricity.

Heat market

At KOGENERACJA S.A., network heat is produced together with electricity in a high-efficiency cogeneration process at the following three plants: two CHP plants (EC Wrocław and EC Zawidawie) and a CHP plant in Siechnice (EC Czechnica).

KOGENERACJA S.A. production plants

EC WROCŁAW

Coal-fired unit

812 MWt

263 MWe

Local distributor’s (Fortum) heat distribution network

EC CZECHNICA

Coal-fired unit

247 MWt

100 MWe

Heating network: 27 km

EC ZAWIDAWIE

Gas-fired unit

21 MWt

3 MWe

Heating network: 2,7 km

The price of heat is regulated (heat tariffs are subject to approval by the President of URE). The development of the heat market is mainly the result of new connections made as new buildings are constructed and as local boiler plants and individual furnaces are put out of use under low-emission programs implemented in cooperation with local authorities.

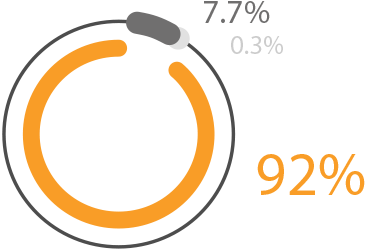

Chart. Buyers connected to heat distribution systems

- Fortum Power and Heat Polska Sp. o. o. O/Wrocław

- Heat network in Siechnice

- Heat network in EC Zawidawie

Electricity market

In 2018, the annual electricity consumption in Poland was 170.9 TWh (vs. 168.1 TWh in 2017). According to the Energy Policy until 2040 (PEP 2040), the consumption of electricity per capita in Poland is expected to grow by close to 46% until 2040 and the average annual increase is estimated at 1.7%.

Electricity production in Poland is predominantly based on hard coal and lignite which makes the domestic electric energy industry susceptible to changes in the prices of CO2 emission allowances and of coal prices. 2018 was characterized by a rapid increase in wholesale prices, mainly as a result of the rising cost of CO2 emission allowances, the price of which went up from EUR 5-6 per ton of CO2 to EUR 20-22 per ton of CO2 over the year. The increase in electricity prices had a bearing on contracts for 2019.

The increase in energy rates was curbed by the Act on Electric Energy Prices adopted on 29 December 2018 which covers all domestic buyers, that is more than 17.5 electricity users in Poland. The Act introduces a program which consists of four measures aimed at stabilizing electric energy process in 2019:

- reduction of the excise duty imposed on energy from PLN 20 per MWh to PLN 5 per MWh,

- reduction of the transitional fee for all electricity buyers by 95%,

- direct compensation for lost profits of energy trading companies,

- allocating around PLN 1 billion to fund pro-environment investments.

The regulations enacted by force of the bill will have a major impact on the energy market in 2019.

Other developments and factors having a bearing on the performance of the energy industry in 2018 and in subsequent years include:

- ”Clean Planet For All” – a document of the European Commission released in November 2018 presenting a long-term vision of reaching the goal of zero net emissions by 2050 so that the European Union becomes “climate neutral” i.e. generates minimum emissions and uses carbon capture and storage technologies. The strategy assumes withdrawal from the use of coal and departure from reliance on oil and gas.

- 2030 Climate and Energy Framework setting the goal for reduction of greenhouse gas emissions by 2030.

- Work on the draft of Poland’s Energy Policy by 2040.

- Work on the new mechanism of supporting high-efficiency cogeneration (as escribed in the Heat Market) section.

- Launch of the Capacity Market.

Capacity Market

The capacity market was launched in Poland by force of the Act of 8 December 2017. According to the provisions of the Act, capacity is treated as a commodity which can be purchased and sold. Power Generating Units (”PGU”) will receive compensation for their readiness to supply electric capacity to the system at rates determined in the course of an auction. On 27 July 2018, an intra-group Agreement was signed on Capacity Market Management by PGE Group Companies, including KOGENERACJA S.A. and EC Zielona Góra S.A. Under the agreement, all activities related to the capacity market will be centrally coordinated and managed by PGE S.A. The companies will generate additional revenues in return for their commitment to supply capacity to the system which will facilitate the implementation of the Group’s business strategy and carry out the planned investment programs.

In November and December 2018, three auctions were held on the capacity market for supplies to be executed in 2021, 2022 and 2023.

The results of the initial auctions were announced to the public in the current reports of PGE S.A. no. 35/2018, 39/2018 and 41/2018 available at https://www.gkpge.pl/Relacje-Inwestorskie/Raporty-biezace.

Table. Units pledged by KOGENERACJA S.A. for the capacity market auctions

| 2021 | Capacity offered [MW] |

Auction won | Contract duration [years] |

|---|---|---|---|

| Wrocław B3 | 66 | YES* | 7 |

| Czechnica | 25.5 | YES | 1 |

* Unit B3 has won a 7-year contract in 2021 and therefore it will not take part in auctions for capacity supply over the next 7 years; the settlement summary for the period between 2022-2023 shows the contract from the first auction.

| 2022 | Capacity offered [MW] |

Auction won | Contract duration [years] |

|---|---|---|---|

| Wrocław B1 | 21.878 | YES | 1 |

| Wrocław B2 | 66 | YES | 1 |

| Wrocław B3 | 66 | CONTRACT OF 2021 | 7 |

| Czechnica | 25.5 | YES | 1 |

| 2023 | Capacity offered [MW] |

Auction won | Contract duration [years] |

|---|---|---|---|

| Wrocław B1 | 21.878 | YES | 1 |

| Wrocław B2 | 66 | YES | 1 |

| Wrocław B3 | 66 | CONTRACT OF 2021 | 7 |

Czechnica CHP did not take part in the auction for 2023, as it will be replaced by a new generation unit. EC Zawidawie unit did not take part in any of the auctions as its role is to support high-efficiency cogeneration.

The power generating units of KOGENERACJA S.A. which have not qualified for the capacity market will be subject to direct settlements as part of PGE Group for the provision of capacity pledging services.

Electricity buyers

Four Polish energy companies (PGE, Enea, Energa, Tauron) have a combined share of 60% in the electricity generation market. PGE S.A. Group of which KOGENERACJA S.A. is a member is an unquestionable market leader in energy production and has a nearly 45% market share.

KOGENERACJA S.A. is the largest producer of heat and electricity for Wrocław. EC Wrocław has a license for electricity production with a capacity of 263 MWe. EC Czechnica has a license for electricity production with a capacity of 100 MWe.

KOGENERACJA S.A. produces electricity in association with network heat, in the process of high-efficiency cogeneration. Part of it is produced from renewable energy sources (RES). Biomass is combusted in dedicated installations as an alternative to coal, which helps to reduce CO2 emissions.

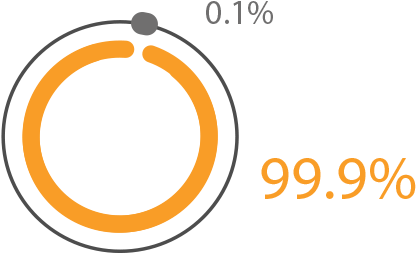

Chart. Electricity buyers

- PGE Energia Ciepła S.A.

- End users

KOGENERACJA S.A. also provides plant availability services (ancillary services) to PSE-Operator S.A.